AI and the 1990s Internet Playbook

January 16, 2026

As we wrap up January, we want to briefly revisit a market comparison we’ve been tracking closely at Bull Run.

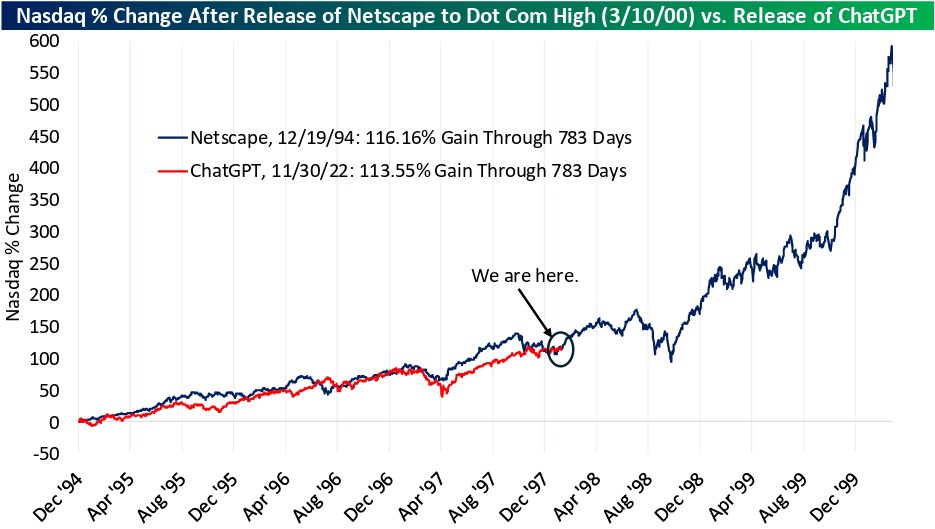

The chart below compares the Nasdaq’s performance following the release of Netscape in late 1994 with its performance since the release of ChatGPT in November 2022. The alignment between the two periods remains striking, with both rallies showing nearly identical gains through the same point in time.

Based on the 1990s timeline, today roughly corresponds to early 1998. That year was not smooth. Markets experienced real volatility driven by the Asian financial crisis, Russia’s debt default, and the collapse of Long-Term Capital Management. Importantly, however, the Internet boom had not yet gone parabolic. That phase did not arrive until late 1998 through early 2000.

What makes this comparison particularly interesting is leadership. At this stage in the 1990s, performance was driven primarily by Internet infrastructure companies. The later explosive gains came when Internet implementation companies began to IPO and attract significant capital.

So far, the current AI cycle has followed a similar pattern. AI infrastructure companies, particularly chips and data centers, have led the rally. What we have not yet seen is a broad wave of AI implementation IPOs or sustained breakouts across that segment of the market.

If history is any guide, the later innings of this cycle are likely to arrive when capital begins rotating more aggressively into AI implementation companies and IPO activity accelerates. It would be fitting if the cycle ultimately peaked after the AI implementation company that helped ignite it all, OpenAI, eventually goes public.

We continue to focus on positioning portfolios for long-term growth by owning the companies building the foundation of this shift, while staying disciplined as the cycle evolves.

Sign up for our weekly newsletter.

Market Insights

Comprehensive market insights keep you informed. Our experts analyze financial trends and how they affect your investments and financial strategy. We give you a deep understanding of market dynamics to help you make smart decisions.

Questions? Seeking Further Insight?

Connect with our experts at BRIM.

“It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

Warren Buffet

.png)

.png)

.png)